In an era of rapid change, life insurers are facing unprecedented challenges. Our World Life Insurance Report 2025 provides invaluable insights into how insurers can adapt and thrive by embracing customer-centric strategies, cutting-edge technologies, and innovative solutions.

The future of life insurance is customer-focused, flexible, and personalized, with a focus on improving customer experience (CX) and driving long-term value for policyholders.

Key Insights:

- Changing Consumer Expectations: Life insurance is shifting from a “must-have” product to a “maybe” purchase. Consumers are looking for solutions that go beyond traditional death benefits. Financial wellness, retirement planning, and personalized coverage are becoming the new essentials.

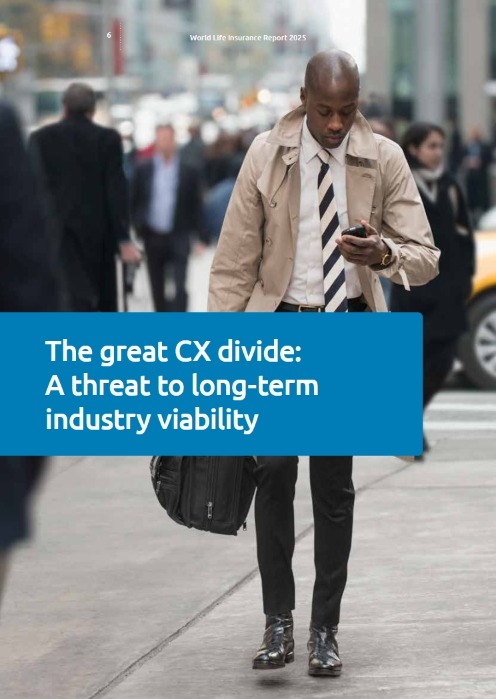

- The CX Divide: Despite rising interest rates, customer dissatisfaction remains high. Only 5% of life insurers can be considered best-in-class, consistently delivering personalized experiences. Many insurers still struggle with outdated systems, complex policies, and lack of transparency in pricing.

- The Role of Technology: Generative AI (Gen AI) and intelligent automation are transforming the industry, offering insurers the tools to modernize legacy systems, streamline processes, and enhance the customer journey.

- The Path to Transformation: Successful life insurers are building a future-ready workforce, leveraging AI to create seamless, empathetic customer experiences, and cultivating a customer-first culture.

Our Strategic Blueprint for Insurer Success:

We’ve developed a comprehensive blueprint to help life insurers navigate the complexities of legacy technology, outdated practices, and evolving consumer needs. This blueprint is designed to:

- Boost operational efficiency through automated underwriting and streamlined claim processes.

- Increase customer satisfaction by embracing AI-powered tools for personalized engagement and self-service.

- Build long-term trust with transparent pricing, flexible coverage, and solutions tailored to the needs of today’s consumers.

- Maximize lifetime value by focusing on personalized customer journeys that foster loyalty and engagement.

Why Transformation Matters:

The life insurance industry’s growth is stagnating, with penetration rates declining in mature markets. But this is also a huge opportunity to reimagine the role of life insurers in the lives of customers. By focusing on financial wellness, offering flexible insurance products, and leveraging AI technologies, insurers can help policyholders secure their financial futures while driving growth and profitability.

- 38% higher Net Promoter Scores (NPS)

- 11% lower expense ratios

- 6% higher growth than industry averages

What Consumers Want Now:

Consumers need insurers to help them secure long-term financial stability. As inflation impacts budgets, retirement savings remain low, and younger generations struggle to save, life insurers must step in as trusted advisors, providing clear, understandable, and flexible insurance options.

- 54% of U.S. households have no retirement savings.

- 39% of Europeans are not saving for retirement through a voluntary pension plan.

With the right strategies and digital capabilities, life insurers can meet these evolving needs and drive long-term loyalty and value.

Take Action Today:

In an industry filled with competition and change, the time to act is now. Leverage the World Life Insurance Report 2025 to drive innovation, transform your business, and deliver exceptional customer experiences that build trust and long-term value.

Explore the full report to see how your organization can thrive in the evolving world of life insurance.

This article is posted at capgemini.com

Please fill out the form to access the content